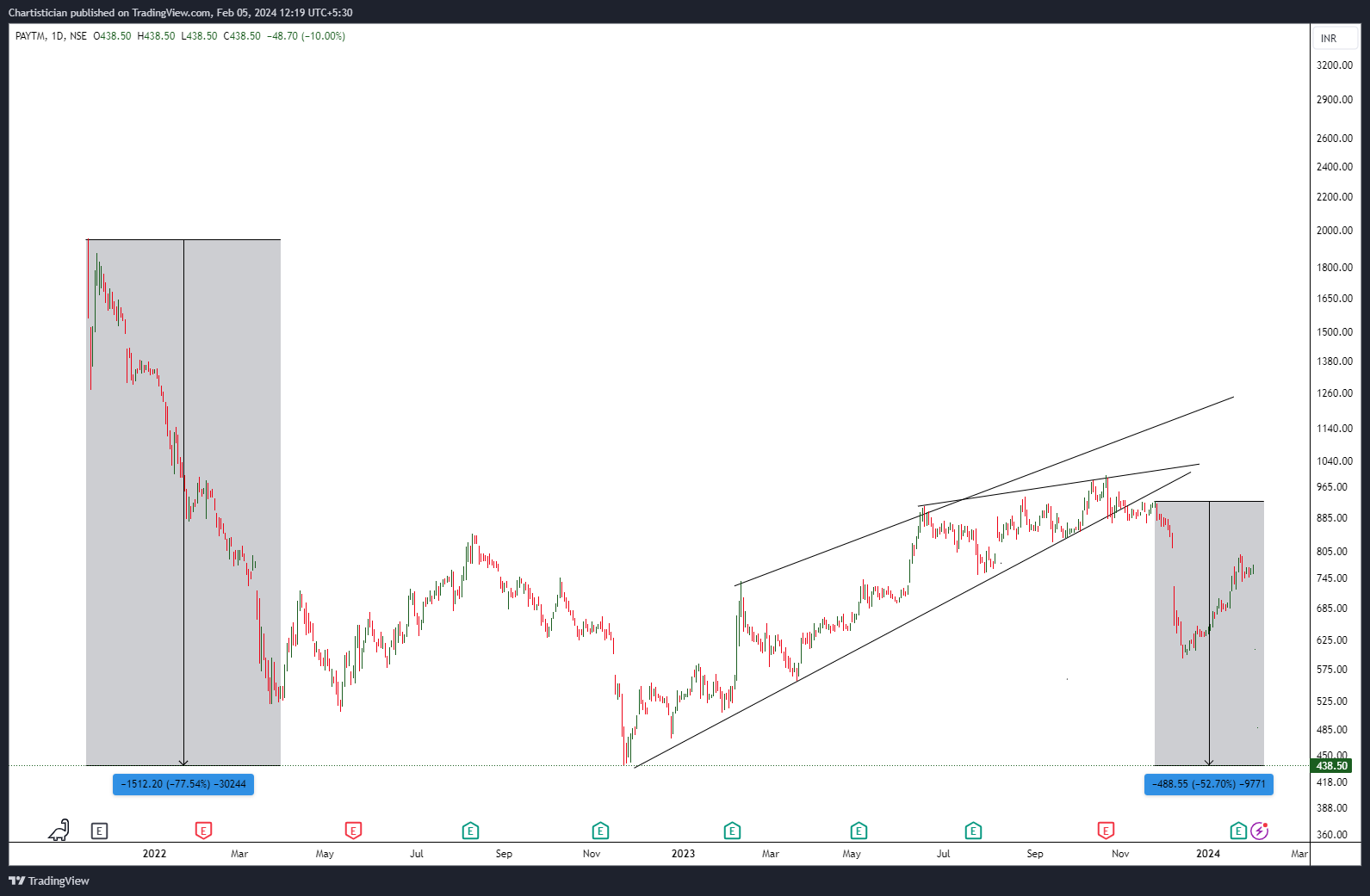

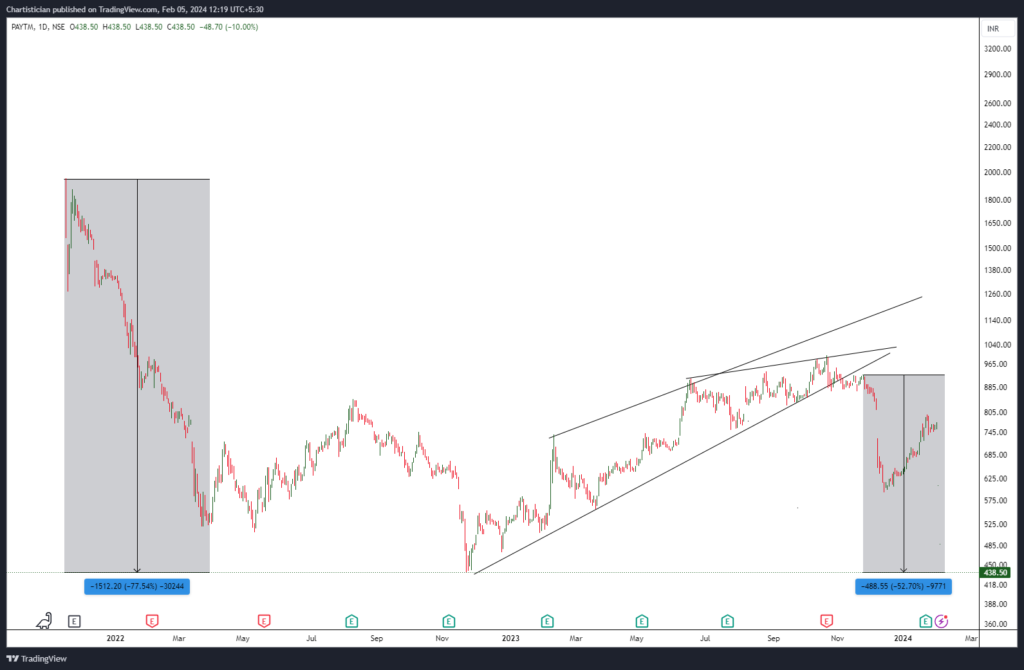

Paytm, the leading Fintech, has been a case for mass destruction despite as a product; it is no doubt that the Founder of Paytm, Vijay Shekhar Sharma’s view, was ahead of time.

But interestingly, the stock has been eye candy for traders and investors who always look to pull the trigger on this stock. Be it short-term trading due to some event or news or long-term investing based on its future growth story as a significant player in the fintech space. It has been a dubious case.

Cut to the chase: It is a case study for many and some simple logic (obviously, hindsight bias ).

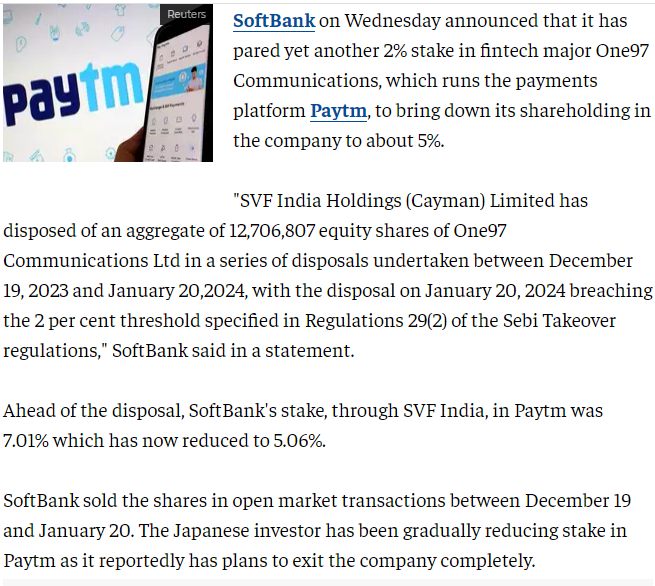

The basic rule/logic or brainstorming- What Happens when the major investor in a Fintech exists just a Year(Trading Days) from the share price listing? The stock was listed on 18 Nov 21, and Softbank trimmed its stake on 11 May 2023.

To add to that, Softbank trimmed another 2%, which was completed on 24th January! is just about time. “Are Jab Investor hi sure nahi hai to retail investors ko itna kyu pump kar rahe hai sab Buy karne ke liye??

Look at the image below! BoFA, GS etc aur pata nahi kaun kaun!

To add insult to injury, Warren Buffet, The Living God of Investing(Omaha) Exited the business with a 600 Cr Loss! Investors should ask – “To Phir, retail kyu buy kar rahe the!?

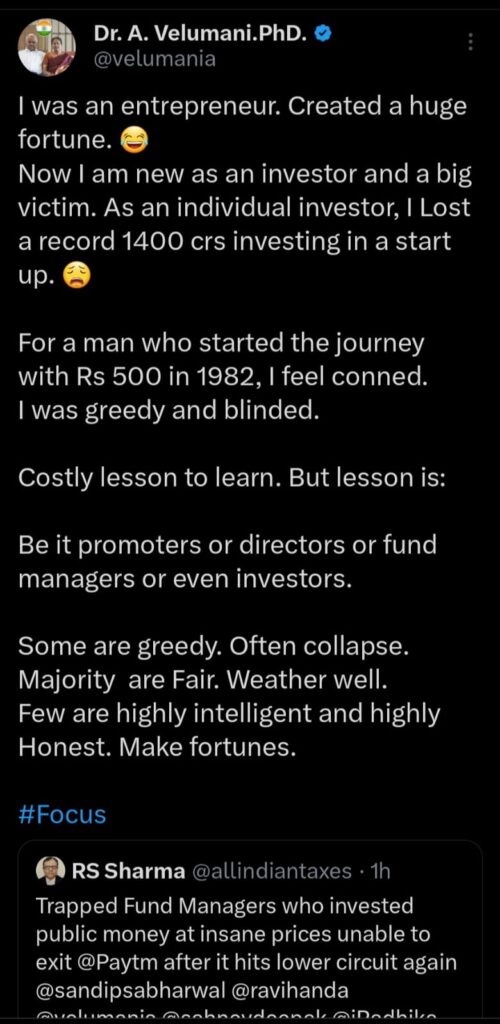

Lastly, Sir Dr A Velumani, who created multi-billion dollar Thyrocare, is also stuck with 1400 Crore and lost. I admire his work, but this also shows that even genius failed in this whole saga of investing, and we all make mistakes. We can learn a lot from this.

Anyhow. The comments from the RBI are serious. Another major player will soon acquire the company. (Ambani-Adani)

Remember – The fine line between short-term trader and long-term investor is – Stoploss.

MarketFeds

Lovelesh Sharma

CMT, CFTe